Kaspi: Gateway to Digital Convenience in Central Asia (NASDAQ:KSPI)

The thriving Kazakh SuperApp poised for regional dominance

In the heart of Central Asia, Kaspi is redefining the financial landscape, emerging as a beacon of innovation and convenience. Born as a traditional bank in 2008, it transformed into a dynamic digital ecosystem, encompassing a thriving marketplace, a versatile payment platform, and a broader fintech solution. By seamlessly connecting consumers to a spectrum of ever-increasing services, Kaspi has established itself as a one-stop digital powerhouse, transforming how people live their lives and allowing its users a uniquely digital-first connected experience. This deep dive analysis delves into the intricacies of Kaspi's business model, explores its alluring facets and considerations, and presents what I believe is the most compelling investment case in the markets today.

Investor Relations | Earnings Report 3Q23 | Form F-1 Draft Prospectus

As a paid subscriber, you'll gain access to a proprietary operating and returns model that will empower you to tweak inputs and develop your own investment perspective. My mission is to engage with you and the whole community, question each other’s assumptions, learn and get smarter together so we can make strong and data-driven investment decisions and all achieve financial independence.

Kaspi's Evolutionary Journey

Kaspi's journey from its origins as a traditional bank to a leading digital SuperApp is a remarkable tale of evolution and foresight. Founded in Kazakhstan in 2002, it initially operated within the conventional banking framework. However, visionary leadership and a relentless focus on innovation saw Kaspi pivot dramatically following Mikheil Lomtadze becoming the CEO in 2007. By leveraging technology, Kaspi expanded beyond banking, offering a marketplace platform that revolutionized retail and e-commerce in the region. Adding payment solutions and fintech services transformed Kaspi into a holistic SuperApp, simplifying the financial and commercial needs of millions, all under one digital roof. This evolution wasn't just a change of services but a reimagining of consumer engagement, setting Kaspi apart as a vanguard of digital transformation in Central Asia. As of 3Q23, Kaspi has 13.5m Monthly Active Users (MAU) and an impressive 8.8m Daily Active Users (DAU) across Kazakhstan with its ~20m population.

Fintech, Payments, and Marketplace Flywheel

Kaspi offers a comprehensive range of services across three key segments which mutually reinforce each other in a virtuous flywheel:

I. Payments Segment:

Kaspi's payments segment has fundamentally transformed transaction methods in Kazakhstan. Its mobile wallet facilitates instant payments, transfers, bill payments, and mobile top-ups, integrating seamlessly into the daily lives of its users. The efficiency, security, and convenience it offers draw parallels to established fintech players like Block (NYSE:SQ).

Kaspi monetizes this segment by taking a fee on processed transaction volumes. With Kaspi Pay, the Company effectively circumvents traditional card networks and provides payment processing services akin to Adyen (albeit mostly to SMBs rather than enterprises; ADYEN.AS). This dual role allows Kaspi to capture value at multiple points in the transaction chain.

In 2019, Kaspi processed a modest 2% of Kazakhstan's transaction volumes, with the majority dominated by Visa and Mastercard. However, in a striking shift, Kaspi has now emerged as the leading payment provider in the country. Today, over 90% of in-store transactions made through Kaspi are processed using its Kaspi Pay acquiring service, underscoring its rapid ascendancy and the effectiveness of its strategy in overtaking traditional payment giants. This dramatic growth highlights Kaspi's deep market penetration and capability to revolutionize payment systems in a strikingly short time frame.

Key Metrics 2023E (see model for details): 12.9m Active Users (94% of Group MAU), $63bn processed volume (44% YoY growth), 1.65% take rate (down from 1.67% in 2022A) —> $1.0bn Revenue (43% YoY growth) with $0.7bn Net Income (65% margin)

II. Marketplace Segment:

Kaspi's marketplace segment marks its strategic positioning in e-commerce, creating a dynamic platform for buyers and sellers. This segment, rapidly evolving to mirror the likes of Amazon (NASDAQ:AMZN), offers diverse products and services, streamlining online shopping experiences with remarkable ease and efficiency.

It broadens consumer choices and empowers local businesses by giving them a digital presence and access to a wider customer base. E-commerce is still in its early innings in Kazakhstan, with current penetration of only 10.7% and expected to reach 20%+ by 2027E. Initially focused on electronics, the platform has successfully branched into various other SKU categories (from 2.4m in 3Q22 to 4.5m in 3Q23). This expansion is a strategic move that has significantly driven up the take rate – from 6.0% in 2018 to an estimated 10.3% in 2023E. This increase in the take rate is a clear indicator of the platform's growing appeal and efficiency in the e-commerce space. Comparatively, Mercado Libre has a take rate of ~14%, suggesting that there is still meaningful room for Kaspi to grow and increase its take rate further in the coming years.

Additionally, Kaspi's marketplace segment has significantly enhanced convenience for its customers by introducing Postomats (akin to InPost; INPST.AS). These automated parcel delivery terminals allow for easy, secure, and swift collection of online purchases, further streamlining the e-commerce experience - there are currently 5.2k terminals through which customers pick up 37% of all e-commerce orders.

Key Metrics 2023E (see model for details): 7.0m Active Users (51% of Group MAU), $9bn GMV (46% YoY growth), 10.2% take rate (up from 8.4% in 2022A) —> $0.9bn Revenue (78% YoY growth) with $0.6bn Net Income (61% margin)

III. Fintech Segment:

Kaspi's fintech segment stands at the forefront of its offerings, providing innovative financial solutions. This segment includes a diverse range of banking services, loans, and credit products, such as a buy-now-pay-later (BNPL) option, all seamlessly accessible through its digital platform. This arm of Kaspi is akin to the fintech services offered by companies like Block/AfterPay (NYSE:SQ) or Affirm (NASDAQ:AFRM), designed to simplify and enhance the personal finance management experience with its tech-driven approach.

Kaspi excels in its fintech metrics, primarily due to its effective risk management capabilities. The Company's extensive real-time data on customer lifestyles and transactions enables it to predict delinquencies accurately. This proficiency is reflected in a low and consistent delinquency rate of ~2%, with improving loss rate vintages. Even during unprecedented challenges like the Covid-19 pandemic, Kaspi managed to maintain stability without any significant disruptions or spikes in delinquencies. This resilience and handling of risks underscore Kaspi's strength in the fintech sector, offering customers a reliable and secure financial service platform.

Key Metrics 2023E (see model for details): 6.1m Loan Customers (45% of Group MAU), $7.5bn Average Net Loan Portfolio (33% YoY growth), 34% yield (flat vs 34% in 2022A) —> $2.2bn Revenue (38% YoY growth) with $0.7bn Net Income (30% margin)

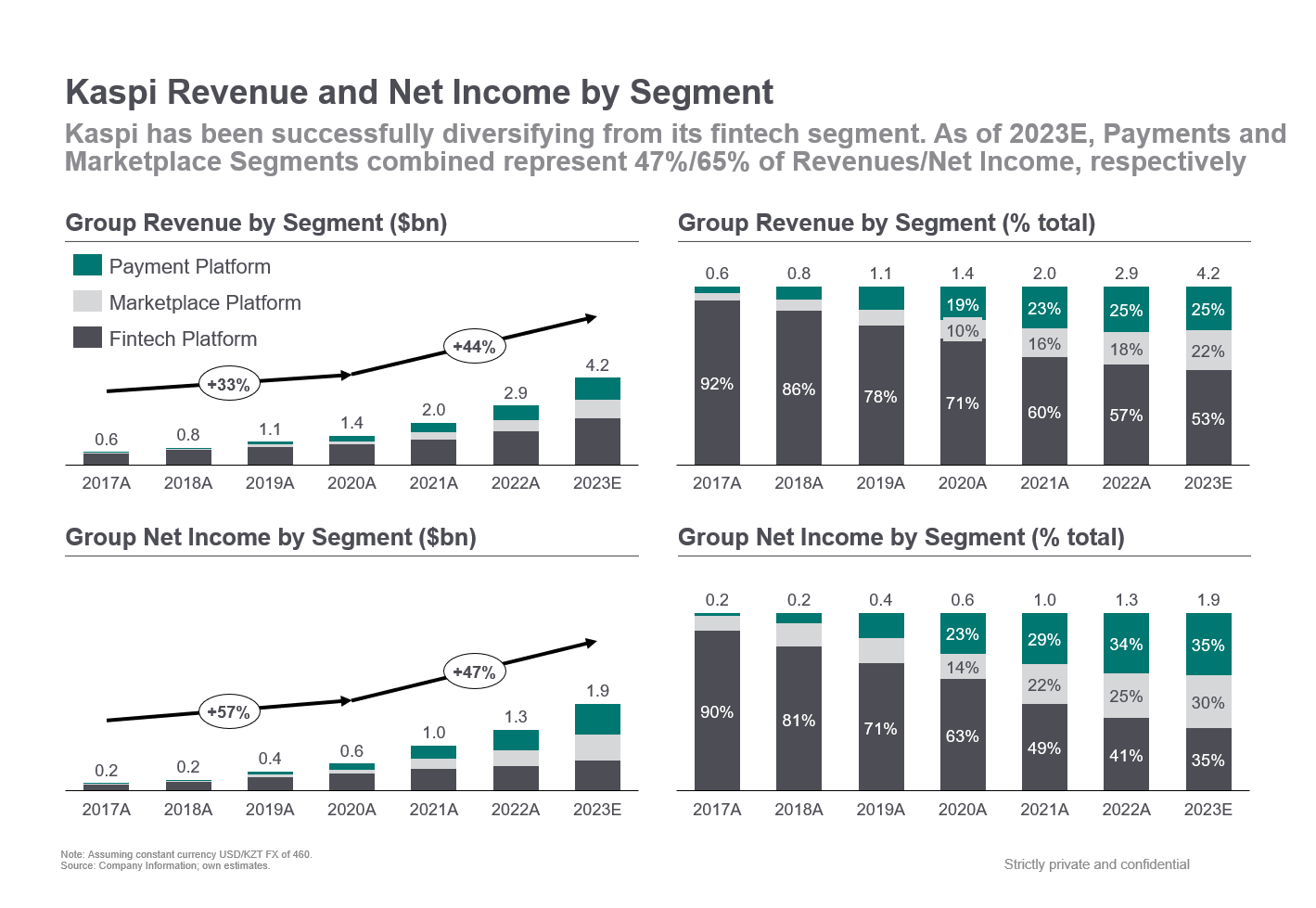

Indeed, all three segments are fast-growing and profitable. Kaspi’s strategy to ensure profitability in each segment from the outset was necessitated by its limited access to funding, eliminating the possibility of cash burn typically seen in growth-stage companies. This approach, born out of necessity, has become a deeply ingrained cultural element within the Company, guiding its business practices and shaping its sustainable growth model. In 2023E, I expect Kaspi to generate ~$4.2bn Revenues (47% YoY growth) and ~$1.9bn Net Income (42% YoY growth, 42% margin).

Each segment demonstrates Kaspi's commitment to leveraging technology for financial and commercial convenience, cementing its status as a SuperApp in the region. As shown below, Kaspi’s journey from a pure-play fintech provider towards a holistic SuperApp stands out when looking at Revenue and Net Income breakdown by segment.

Kaspi transcends being “just” a consumer-focused SuperApp; it's also pivotal for merchants, creating a self-reinforcing ecosystem offering businesses tools for sales, payments, and customer engagement to empower them to thrive in the digital economy. This dual approach enhances consumer experiences and drives merchant success, fostering a closed-loop ecosystem where both parties benefit and contribute to Kaspi's expansive network. This symbiotic relationship underpins the platform's continual growth and innovation.

Speaking about the pace of innovation, Kaspi’s commitment to keep reinventing itself and expanding its addressable market is evident in its continuous product launches, including many of its latest ventures. The SuperApp has adeptly expanded into new domains with the launch of Classifieds (akin to AutoTrader; LON:AUTO), e-Grocery (akin to DoorDash; NASDAQ:DASH), and Travel services (akin to Booking.com; NASDAQ:BKNG), rapidly establishing market leadership in each. This expansion not only diversifies Kaspi's offerings but also cements its status as a pivotal, all-encompassing platform for consumers' diverse needs in Kazakhstan, from daily essentials to leisure and lifestyle.

As of writing, Kaspi has arguably established the widest set of products and features across all major SuperApps globally, including such behemoths as Alibaba, Mercado Libre, and Nubank. The Company is not stopping there; rumours suggest that the business is debating launching taxi services as soon as 2024, though it is yet to be confirmed (akin to Uber; NYSE:UBER). What might come as a surprise is that Kaspi plays a pivotal role in streamlining government-related services for its citizens. This aspect of Kaspi's platform simplifies various bureaucratic processes, enhancing public service accessibility and efficiency. Such functionality benefits users and reflects Kaspi's positive and constructive relationship with the government, showcasing a collaborative approach to technological and societal advancement. In fact, Kazakh President Kassym-Jomart Tokayev has, on multiple occasions, emphasized the important role of Kaspi in capital market development of Kazakhstan, its impact on improving the life of Kazakh people and overall seems understandably proud and supportive of the business (Kaspi has all it needs to become a truly formative business in the context of Central Asia as Shopify became in Canada, and thus drive entrepreneurship and be a force of innovation in the region).

Kaspi’s innovative nature has been rewarded by a significant surge in user engagement, with its DAU to MAU ratio climbing to an impressive 65% as of 2Q23, a leap from 27% just five years ago. This metric, a testament to the SuperApp's sticky user experience, is second only to WeChat's 86%, largely attributed to its messaging capabilities (akin to WhatsApp). Kaspi's multifaceted platform fosters habitual user interaction, with its diversified services seamlessly integrating into its consumers' daily digital routines. Note that the only meaningful competitor is Halyk Bank; however, it is first and foremost a bank with limited SuperApp-like functionalities, hence not much focus on the competitive landscape in this deep dive as Kaspi is truly one-of-a-kind 800-pound gorilla in its end-markets.

Redefining Efficiency in High-Growth Markets

Efficient growth is vital for scaling a business successfully with a strong Return on Invested Capital (ROIC). Otherwise, businesses end up “spinning the wheels” with growth materially slowing down with scale, profitability being difficult or impossible to reach, and in the worst cases, both of the above combined with the need for incremental capital raises resulting in ongoing shareholder dilution. Unfortunately, few businesses globally can achieve sustainable and attractive growth efficiencies. Most companies struggle to achieve high ROIC, which applies even to the leading cloud businesses, considered one of the best business models in the history of capitalism. Even the best-of-the-class SaaS companies currently face a median marketing spend payback period (on a Gross Profit basis) of around 28 months (see Meritech Software Pulse). Over time, as businesses scale, efficiency often wanes—initial easy wins are exhausted, and attracting more elusive customers becomes challenging and costly.

Conversely, Kaspi's SuperApp enjoys extremely high engagement, making consumer participation essential to living their lives efficiently - it is not an understatement to say that not using Kaspi in Kazakhstan is equivalent to being an unbanked individual with no form of identification in the Western World. For merchants, Kaspi provides the optimal way to reach their audience, much like specialized platforms such as Rightmove (LSE:RMW) for real estate in the UK or Mercado Libre for e-commerce in LatAm, though as discussed, Kaspi's scope is far broader. This allows for essentially non-existent churn outside merchants going out of business.

Kaspi's efficiency goes beyond its attractive business model and is further propelled by its innovative use of Artificial Intelligence (AI). This technological edge sharpens Kaspi's operational acumen, enabling the Company to scale its revenues with a lean and, in fact, shrinking workforce. The SuperApp's ability to enhance user engagement and merchant success through AI translates into remarkable financial metrics per Full-Time Employee (FTE), reflecting a synergy of growth, profitability, and efficiency rarely seen in the market. I will let the below data speak for itself and highly recommend you compare the below metrics with an excellent database provided by Meritech in their Public SaaS Comparables Table (where you will quickly find that Net Income per Employee is not a disclosed metric because it is not meaningful for the vast majority of publicly listed high-growth companies as they are deeply cash burning due to the above discussed efficiency-related constraints).

A Customer-First Vision by CEO Mikhail Lomtadze

Kaspi's management, under CEO Mikhail Lomtadze, embodies a long-term, customer-centric philosophy, focusing on product excellence and user experience above all. Lomtadze's strategy hinges on understanding and continually investing in Kaspi's competitive edge, a practice that has led to an ever-expanding market advantage. This approach is reflected in the Company's Net Promoter Score (NPS), which impressively rose from below 40% in the early 2010s to an outstanding ~90%, signalling that customers don’t just use Kaspi — they genuinely love it. This customer satisfaction parallels how Amazon has captivated its user base, making it essentially irrational not to use its services.

“We always proactively seek consumer feedback to evaluate if we are delivering on our mission. Through our Kaspi.kz Super App, we send push notifications asking our consumers to evaluate the quality of specific services and provide us with feedback, shortly after use. On average, approximately 200,000 consumers per month give us such feedback. The data and results we derive from feedback form an integral part of our product development process. For our employees, consumer feedback forms the main KPIs by which they are held accountable.”

Furthermore, this customer-first approach is deeply ingrained in the Company's ethos, partly because all executive officers and members of the Board of Directors as a group (9 persons in total) hold a significant stake in the business, owning 57% of the outstanding shares, currently worth ~$10bn. This substantial ownership ensures that the management's interests are closely aligned with the long-term success and sustainability of Kaspi, mirroring the commitment to continually enhancing service quality and value. Under Lomtadze's stewardship, Kaspi is not just maintaining its market position but is set to become even more integral to its customers' lives. To better understand the impressive culture, I suggest watching publicly available videos on YouTube, listening to quarterly report recordings, and perhaps reading through the Kaspi.kz IPO Harvard Business School Case Study.

Kazakhstan Beyond Borat: A Digital Powerhouse and Eurasian Economic Strategic Keystone

While some may hesitate to invest in an asset exposed to Kazakhstan's economy, perceiving it as an underexplored market funnily known through the "Borat" films, the country's reality is strikingly different. Kazakhstan is exceptionally digitally savvy, with a robust online infrastructure facilitated by the rise of tech giants like Kaspi.

It's also a pivotal node for the Belt and Road Initiative (BRI), vital for Eurasian economic integration, from which all regional stakeholders, including China, Europe, Russia and the Middle East, stand to gain (hence, in my view, the irrelevance of the potential worry that Kazakhstan might face a similar devastating destiny as Ukraine). The nation's commitment to BRI is evidenced by significant infrastructure investments and a surge in trade volume with all stakeholders (including increasingly with Europe to provide Oil & Gas, and with France specifically to replace Niger as the core provider of uranium). Kazakhstan's role extends beyond logistics; it's pivotal in industrial and agricultural collaborations under the BRI, with numerous joint projects underway. These partnerships underscore Kazakhstan's growing importance in regional and global economic dynamics. In 2023, Foreign Direct Investments in Kazakhstan grew by 18% and reached $28bn, a record high for Kazakhstan over the past decade.

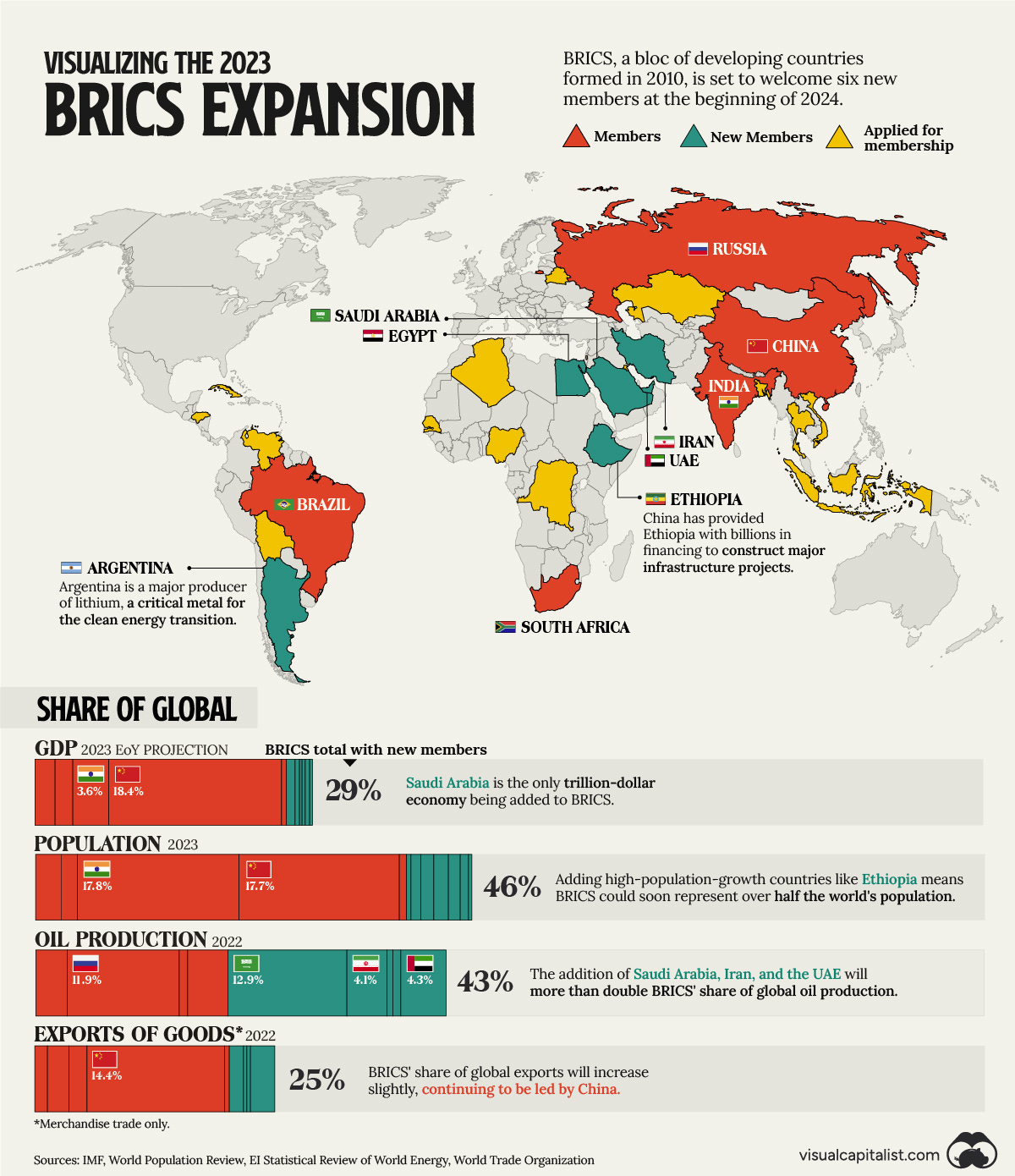

It is also worth noting that on January 1, 2024, the UAE, Saudi Arabia, Ethiopia, Egypt, and Iran officially became members of BRICS. They joined Brazil, Russia, India, China, and South Africa as a formidable economic powerhouse, representing 29% of global GDP and 43% of global oil production. Kazakhstan has shown a keen interest in joining BRICS and will likely do so in the coming year(s), further cementing its geopolitical and economic significance.

Economically, Kazakhstan showcases a trade surplus, abundant natural resources, and a trajectory of growing GDP and income per capita, with inflation increasingly being tamed, resulting in decreasing interest rates, which should further accelerate the economy's and Kaspi’s growth. Below is an overview of a few selected statistics, though I urge you to explore an excellent TradingEconomics database with a broader set of economic indicators that would allow you to form your view based on your risk tolerance.

It is also worth mentioning that Moody's upgraded Kazakhstan's outlook from "stable" to "positive" on October 27, 2023, acknowledging the country's significant progress in diversifying its economy and demonstrating stronger growth prospects than its peers. This positive shift reflects Kazakhstan's commitment to reforms and improving the effectiveness of state institutions. Moody's recognizes Kazakhstan's low debt burden (~25% Debt to GDP vs ~130% in the US) and substantial international reserves, enhancing its resilience to external risks and underscoring its economic strengths.

The Kazakhstani Tenge (KZT) has experienced historical depreciation, largely influenced by external factors and the nation's reliance on raw materials, particularly oil and metals, which account for a significant portion of its economy and currency revenues. This dependence prompted efforts by the Kazakh government to diversify the economy away from these sectors, aiming to mitigate the impact of fluctuating commodity prices on the national currency.

In recent years, the Tenge has shown signs of strengthening. For instance, in 2023, the US dollar exchange rate against the Tenge decreased by ~2%, making Tenge one of the few currencies globally strengthening versus the US dollar. This recent strengthening is attributed to various factors, including economic measures taken by the National Bank of Kazakhstan, the country's growing economic resilience, Kazakhstan's substantial reserves, including assets of the National Fund and gold and forex reserves of the National Bank, which are significant relative to the country's GDP.

Operating & Returns Model

I'm committed to ensuring that all my readers, including those who access my free content, receive valuable insights. To this end, I'm sharing key excerpts from my comprehensive operating & returns model, offering a glimpse into the detailed analysis available. Below, you'll find a snippet of the Marketplace Platform Deep Dive and an overview of the Summary P&L and Returns calculations.

However, to truly delve deeper and tailor your investment thesis, I've reserved the full model for my paid subscribers. This exclusive content includes a Kazakh Macro Overview, an in-depth analysis of both the Payments and Fintech Platforms, a Summary of Operating Free Cash Flow build, and detailed Capital Allocation calculations, which are crucial for reinvesting dividends. My paid subscribers support my work, and in return, I ensure they receive substantial additional value, enabling a more nuanced and personalized investment approach.

Potential Multibagger Hiding in Plain Sight?

It's startling to observe Kaspi's valuation given all that has been discussed thus far, especially when compared with Mercado Libre. Despite Kaspi's robust business model, substantial profitability, a deep competitive moat, and significant market traction, it's shocking to see it trading at a mere ~7x NTM P/E. This is drastically low compared to Mercado Libre's ~48x NTM P/E. Kaspi's strong NTM dividend yield of ~10% and its consistent share buybacks add further to its appeal (note that the business is continuously buying back ~$2.5m worth of shares per week, which more than offsets any dilution from stock-based compensation, yet another attractive facet of Kaspi compared to most of the growth-stage businesses in the Western World). This stark disparity in valuation, with Kaspi valued at a ~85% discount to Mercado Libre, is not just surprising but potentially indicates a massive undervaluation for a Company with Kaspi's impressive credentials.

Note: The chart below shows LTM P/E (the current ~10x LTM P/E translates into ~7x NTM P/E).

Before 2022, Kaspi was trading at ~20x NTM P/E (while the Company was meaningfully smaller and its product and service offering far less developed). However, geopolitical tensions, notably the Ukraine war, sparked concerns about regional stability, leading to a sharp decline in the stock's valuation to the ~7x NTM P/E territory, where it has stayed since. This undervaluation persists despite Kazakhstan's distinct geopolitical context; the likelihood of similar conflicts spilling into Kazakhstan is widely considered very low by regional experts.

Kaspi's impending NASDAQ listing in 1Q24E could be a major catalyst for revaluation (Kaspi is currently listed on the London Stock Exchange). The listing is expected to significantly raise the Company's profile among international investors, attracting the attention of equity research analysts, emerging market hedge funds, and investors seeking exposure to growing fintech, e-commerce, and payments sectors. This increased visibility and subsequent analysis could lead to a more accurate appreciation of Kaspi's true market value. Based on my analysis, here are the expected returns for Kaspi:

Downside Case (15% probability): With a ~10% NTM dividend yield and ~20% NTM growth, maintaining a constant multiple, we could see a 1.3x Money on Invested Capital (MOIC) in one year.

Base Case (50% probability): Adding potential multiple expansion back to the 20x NTM P/E to the same dividend yield and ~30% NTM growth, the expectation is a 3.7x 1-year MOIC.

Upside Case (35% probability): Should the multiple expand to 30x NTM P/E, closer to Mercado Libre (yet still far below ~48x), and growth deliving ~35% NTM growth, a 6.0x MOIC is conceivable.

As attractive as the above illustrative returns appear, the real upside lies in holding Kaspi for the long term, given its vast potential. For a detailed assessment of this potential, I encourage you to explore the financial model available in the paid section.

Putting My Money Where My Mouth Is

In the spirit of Charlie Munger's wisdom, which emphasizes the value of decisive action in investing, I have embarked on a significant personal financial decision. Drawing from my extensive professional investing experience across the world’s leading investment banks and technology-focused private equity firms, I believe I have identified a rare opportunity in the market. Kaspi, a Company that debuted on the London Stock Exchange two years ago, presents what I believe to be a deeply mispriced opportunity. It has somehow stayed under the radar of many international investors, likely due to its listing on the less-observed London exchange (no helpful research analysis covering the stock, daily trading volume of ~$3m, which should be more of a rounding error considering the Market Capitalization of nearly $20bn). Recognizing this, I am investing a substantial portion of my liquid wealth in Kaspi and committing to a long-term hold. This decision is driven by my conviction in Kaspi's potential and my belief that the market will eventually recognize and correct this undervaluation, resulting in potential returns that I currently do not see in other publicly listed investment opportunities.

To all my current, new, and future subscribers, I deeply value and appreciate you! I also warmly invite you to embark on this thrilling journey with me. Your insights and discussions are not just welcomed but crucial as we collectively explore Market Wonders. Together, we aim to uncover opportunities that lead us towards our common goal of financial independence. Let's engage, learn, and grow together in this exciting pursuit!

Very good analyses! I think kaspi is propably the best business in the world. I own a Lot! Two reasons why i dont have even more: the screwed coup showed that is there is some political risk and the TAM is Limited even included the other "Stans".